Multiday Page

NeoTrader

Last Update 4 tahun yang lalu

MULTIDAY TRADES

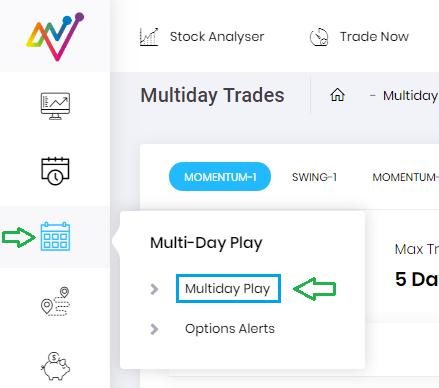

Toggle to the third icon after the NeoTrader Opening page loads and click on Multiday Trades.

This module provided in‐depth detail of Trades generated by NeoTrader Application for Swing Traders (2 days to a week horizon) with Performed Strategy, timeframe, Entry, Exit, Stop Loss, Trailing Stop, etc. Hence, the user can fine‐tune and revise his approach to a greater level of detail.

This Module has two different Segments:

1. Multiday Trades Filters

2. Multiday Trades Results

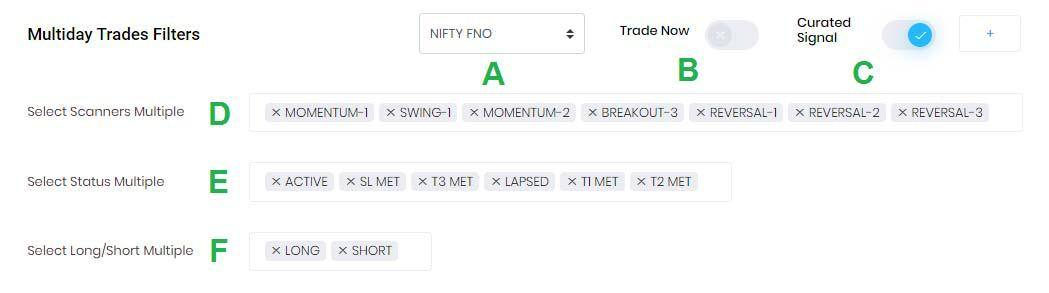

Multiday Trades Filters

A – The user can select the group of stocks from the drop-down menu on which he/she wants NeoTrader to generate the trades. The current universe comprises Nifty50, Nifty Next 50, Nifty Bank, Nifty Mid‐ Small, Nifty FnO, and Watchlist. See the details on the Watchlist page on how to proceed.

B – Trade Now is a feature to filter the trades that are active at the moment and can be traded right now.

C – Curated Signal is a filtration technique used to filter recommendations based on technical parameters to ensure results shown to have a higher probability of success.

D – Users can filter the Trade results by selecting one or multiple strategies according to their analysis. NeoTrader highlights various types of strategies that have been Designed and Back‐tested. Most of the strategies are covered across different sets of webinars/training workshops that Chart Advise has conducted. The strategies are based on Momentum, Pullback, Breakout, and Reversal.

E – User can filter the history of the trades according to the status that was achieved after the trade was recommended by NeoTrader. The results will be filtered to match the criteria as per the input by the User. The algorithm monitors the health of the trade and assigns different labels to immediately alert the user at every refresh. The user needs to be aware of the following types of status labels.

•Active – Trades that are activated now

•SL Met – Trades that triggered stop loss level

•T1 Met – Trades that met First Target

•T2 Met – Trades that met Second Target

•T3 Met – Trades that met ALL Targets

•Lapsed – Trades that were initiated but did not achieve even T1 nor triggered stop loss

F – This filtration helps the User to select based on which side of the market he/she wishes to review the trades i.e., Long or Short.

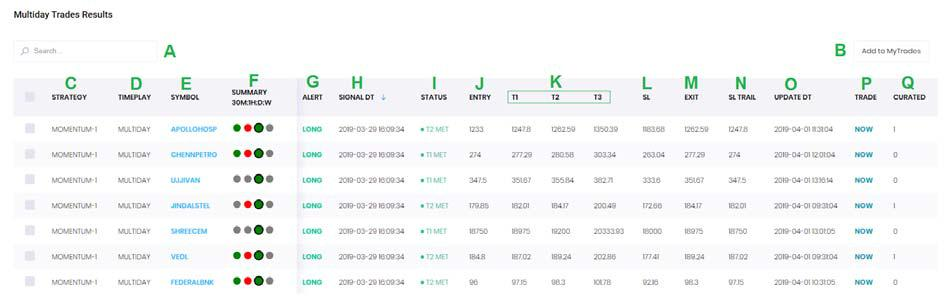

Intraday Trades Results

A – Search Function allows user to type in the name of the symbol/strategy and check if trades have been generated matching the criteria. This also helps the user to watch the history (generated trades) of particular input (Stock / Strategy).

B – Add to My Trades allows the user to transfer the selection to the My Trades section so that the user can keep track of all the progress/updates.

C – Strategy highlights the method that was used to generate the trade.

D – Time play is the indication of holding period for the trade recommended – Multiday (Position to be carry forwarded after initiation and the time horizon differs from 2 days to a week).

E – Symbol is an acronym for security as defined by NSE / BSE.

F – Summary shows if there is a Buy or Sell Signal in that security across 30 min / 1 Hourly / 1 Day or 1 Week. Through these simple and powerful 4 circles, Users can identify how the stock is placed for trade.

•Grey Circle indicates the neutral status in that timeframe

•Green Circle indicates buy-in that timeframe

•Red Circle indicates a sold status in that timeframe

•When it’s a Red or a Green circle with a black outer rim it highlights that a signal (Buy or Sell) has been generated in that timeframe

G – Alert shows what kind of signal has been generated – Long (Buy) or Short (Sell)

H – Signal DT shows the date and time of the signal generation.

I – Status shows the stage at which the trade is; post the current data refresh. Types of status labels:

•Active – Trades that are activated now.

•SL Met – Trades that triggered stop loss level.

•T1 Met – Trades that met First Target.

•T2 Met – Trades that met Second Target.

•T3 Met – Trades that met ALL Targets.

•Lapsed (Green) – Trades that were initiated but did not achieve T1 or triggered stop loss and to be exited with nominal Profit.

•Lapsed (Red) – Trades that were initiated but did not achieve T1 or triggered stop loss and to be exited with nominal Loss.

J – Entry is the price at which the trade is initiated based on the mentioned strategy.

K – T1 (First Target), T2 (Second Target), and T3 (Final Target) are the targets that are expected to be achieved.

L – SL (Stop Loss) is the price which if triggered leads to the Exit of the trade.

M – EXIT is the price where an active trade needs to be exited.

N – SL TRAIL is part of risk management. As the recommendation continues in the direction of the trade and reaches the first level of resistance, the stop loss is trailed to reduce the amount of risk carried.

O – UPDATE DT is the last update processed time for the trade recommendation. The updates are shown in Status.

P – Trade indicates whether the recommendation has been processed as part of fresh trade or an Update to the earlier generated trade. If a column has the value “NOW”, then it is fresh trade generated while “UPDATE” shows the review towards the trade generated earlier.

Q – CURATED has a value of ‘0’ or ‘1’ based on whether filtration parameters have been applied or not. If the column value is ‘0’, there is no advanced filtration Algo used in the generation of trade while if the value is ‘1’ then the advanced filtration technique is applied.